Last Dollar Grant is Now Open!

What is a Last Dollar Grant?

The Last Dollar Grant is a need-based grant opportunity exclusively for Crosby Scholars. Scholars must demonstrate not only financial need but also remaining need after the school of choice has awarded aid. Crosby Scholars who complete the Crosby Scholars Program their senior year with a cumulative GPA of 2.0 or higher are eligible to apply for a Last Dollar Grant for up to 4 years of undergraduate study within 6 years of high school graduation. Even if a Last Dollar Grant is not awarded the first year, the student may still reapply 3 more times.

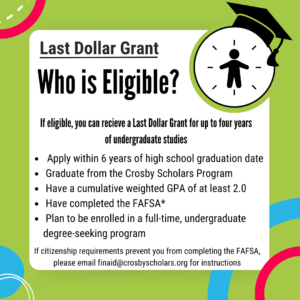

Am I eligible for a Last Dollar Grant?

To be eligible to apply for Crosby Scholars Last Dollar Grant, a student must:

- Complete all requirements of the Crosby Scholars Program

- Have a cumulative weighted GPA of 2.0 or higher

- Complete the Free Application for Federal Student Aid (FAFSA)

- Be enrolling full-time in a two or four year degree seeking program

Documents Required to Apply

The following documents must be uploaded to your Last Dollar Grant application. These documents include:

- Acceptance Letter - From the institution the student will attend

- Financial Aid Offer - From the institution the student will attend

- FAFSA Submission Summary (FSS) - Students can access their FSS by logging into their FAFSA form at StudentAid.gov

If the student does not have the three supporting documents by June 15, they should submit the application and then upload the supporting documents when they are received.

Ready To Apply?

Want to Learn More?

Check Out our Last Dollar Grant Guide!

Scholarships + Financial Aid

APPLY FOR FINANCIAL AID | 24-25 FAFSA (Free Application for Federal Student Aid)

FAFSA: Getting Started

-

Create your Federal Student Aid (FSA) ID. You will need it to access and submit your 24-25 FAFSA.

-

Find out if your parent(s) will need to be Contributors (meaning finding our if their information is required on your FAFSA.) If your parent(s) will need to contribute to your form, make sure each Contributor creates their own FSA ID. Even if a contributor doesn’t have a Social Security number, they will be able to create an FSA ID. Learn more about how to create FSA IDs for Contributors without Social Security Numbers.

Watch our “Preparing for the FAFSA Form” playlist to understand what information and documents you’ll need to fill out the FAFSA form.

CSS Profile: Getting Started

- While all colleges require the FAFSA, some schools also require the CSS PROFILE. The 2024-25 CSS PROFILE became available October 1, 2023. Unlike the FAFSA, the CSS PROFILE costs $25 for the first application and $16 for each additional application submitted. Make sure that your school requires the CSS PROFILE before filling it out. CSS PROFILE fee waivers are available.

Additional CSS Profile Resources:

1. Getting Started: A CSS Profile Tutorial

2. Need guidance on how to report your Parents on the CSS Profile? Reporting Parents: A Guide

3. What if you have a unique family situation? Completing the CSS Profile as the NON CUSTODIAL Parent

For more information on how to complete the CSS / Financial Aid Profile, including a list of colleges, visit BigFuture College Board.

CROSBY SCHOLARSHIPS

Class of 2024 Crosby Scholarships: Deadline April 15, 2024

Crosby Scholarships for Class of 2024 opened November 1. To learn more about our scholarship opportunities, including how to apply for them, please review our Crosby Scholarships Handbook.

Need more resources? Browse our Local, National & Regional Scholarship Database

Sorting through scholarship opportunities can be a time consuming task with difficulty knowing which ones come from legitimate sources.

Let us help you get started by reviewing our Local, National, and Regional Scholarship database to help focus and narrow your search.

STAY INFORMED

Read our monthly newsletter, Smart Money Moves

Smart Money Moves is your monthly guide to Scholarships and Financial Aid information.

NEED HELP?

Schedule a virtual Financial Aid Advising session

Discuss your unique financial situation and have your questions answered by our Crosby Scholars Financial Aid Team. Check out our availability and schedule your session today.

How to Ask for More Financial Aid Due to Special or Unusual Circumstances

Has your family been financially affected by special or unusual circumstances that impacts your ability to pay for college? If so, you should think about writing an appeal letter to your colleg

es Financial Aid office to ensure that you are being offered as much funding as possible. How do you request a change to your Financial Aid offer? SwiftStudent will help you write a financial aid appeal letter for free.

Helpful Links

Need help comparing your Financial Aid Award Letters? Check out this Compare your Aid Award tool from College Board & Big Future.

CFNC: Choosing the Right Loan Worksheet

CFNC: Borrowing Wisely Worksheet

Understanding your Responsibility when Borrowing Student Loans